Do you know which programs you qualify for, and if you’ll be able to get out of paying up to 90% of your debt?

Our team can tell you within 15 minutes on the phone - call us now

Take the 59sec Tax Savings Calculator Now to Find Out:

Verified Client Results:

100% US-Based Staff

Proudly Serving Biloxi, and All of Mississippi

Here's How the Process Works:

Free Initial Consultation and Financial Analysis

15 Minutes - We will go through your entire financial situation, step-by-step and see what programs you qualify for, determine how we can help, and answer any questions that you may have.

Research & Investigation

4-7 Days - Using the Power of Attorney, we will work with the IRS to determine what evidence they have against you (without disclosing anything), so we can create a plan of attack.

Fight for the Best Resolution

1-3 Months - After learning exactly what they have against you, we will negotiate with the IRS on your behalf, removing all the penalties we can, and fighting for a great settlement for you.

FREEDOM!

Forever - Once your tax burdens have been lifted, you can go on living your life again! You will finally be free of the burdens chasing you, and can start fresh with no tax debt!

Say goodbye to your liens, garnishments and tax problems once and for all

Highly Experienced Biloxi Tax Lawyer

The IRS likes to add to the total amount you owe, and certainly will stop at nothing to collect that money on additional fees and interest costs.

They are the greatest collection agency on the planet, and we steadfastly believe that no one should have to face them by themselves again.

For many people, having a government agency that is massive continuously harassing them with letters, notices and revenue officers is a horrifying idea.

That is why our Biloxi team is here to assist you. You no longer have to face the IRS on your own, and will have someone in your corner to help negotiate for you.

If you owe the federal government, or the state of Mississippi, our dedicated law firm is here to make your life easier.

With only 15 minutes on the telephone with our pros, you’ll know precisely what you’ll qualify for, and what to do.

Give our Mississippi team a call now!

Let our Biloxi team enable you to remove a wage garnishment fast, and get back your hard earned money.

What is a Garnish of Wages?

IRS wage garnishment denotes the withholding or deduction of Mississippi wages from an employee’s salary or damages emanating from instances of unpaid IRS taxes. Should you owe the Internal Revenue Service back taxes and don’t respond to their phone calls or payment notices chances are that you may be subjected to an IRS wage garnishment. In other quarters, it’s also called a wage levy or wage attachment. It is worth noting that a court order is generally not needed and other national and state laws pertaining to the overall amount of exempted from garnishment does provide several exceptions for the wage levies.

The garnishment process is generally quite extended, first the IRS determines how much you owe them in back taxes, after this has been done, they’ll send you several payment request notices in the email in addition to more than a single phone call with regards to the debt in question. Failure to respond to the phone calls and notices,automatically leads to a ‘Notice of Intent to levy” being sent to your last known mailing address. You normally have thirty (30) days to touch base with IRS with regards to this notice till they proceed and forwarding the notice to your Biloxi employer. Once this notice was sent to the Biloxi company, you have an additional fourteen (14) days to make a response before garnishment of wages starts. The company generally has at least one pay period before they are expected to send the money, after receiving a notice of levy.

How Much Can the IRS Garnish from My Wages?

IRS garnishment rules generally permit the IRS to deduct or garnish 70% or more of an employee’s wages; this is largely done with the aim of convincing his representative or the worker to touch base with IRS to settle the debt.

Wage garnishments are normally one of the very competitive and severe tax collection mechanisms and one should never take them lightly, as a matter of fact, they would rather work out tax issues differently and only sanction this levy when they believe they’ve ran out of feasible alternatives. This really is normally not possible because of wide selection of motives, even though paying off the taxes you owe the IRS is the simplest way out of such as situation. First of all, you might not possess the tax liability or the entire sum may belong to your ex spouse or someone else, you may be required to establish this though.

What should I do about garnishment?

You thus have to discuss any payment arrangements with the Internal Revenue Service and do so pretty fast. In this respect, it is imperative that you just get in touch with an expert who’ll help you stop or end the garnishment and to easily obtain a wage garnishment discharge. We’re a Biloxi BBB A+ rated tax business with a team of tax attorneys that are highly competent with years of experience along with a long record of satisfied clients to demonstrate this. Touch base with us and we promise to get back to you within the least time possible, usually within one working day or less. We guarantee that will help you reach an amicable arrangement together with the Internal Revenue Service(IRS) and get you a wage garnishment release.

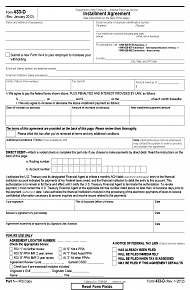

Which means you don't have to pay all at once an Installment Agreement can spread your payments out over time

The IRS Installment Agreement is a means for taxpayers in Biloxi when they can’t pay it in full with their tax return to pay their tax debt. This arrangement allows for monthly payments to be made. So long as their tax debt is paid by the citizen in full under this particular Agreement, they can reduce or get rid of the payment of interest and fees and avoid the payment of the fee that is connected with creating the Deal. Creating an IRS Installment Agreement requires that all necessary tax returns are filed before applying for the Deal. The taxpayer cannot have some unreported income. Individual citizens who owe $50,000 or less in combined individual income tax including penalties and receive can interest 72 months the sum of tax owed .

Good Parts about an Installment Plan

The agreement will result in a few significant benefits for the taxpayer. While an arrangement is in effect, enforced collection actions is not going to be taken. Life will be free of IRS letters and notices. There’ll be more financial independence when the citizen can count on paying a set payment each month rather than having to worry about getting lump sum amounts on the tax debt. The citizen will remove continuing IRS penalties and interest. The IRS will assist the taxpayer keep the agreement in force if the taxpayer defaults on a payment providing the IRS is notified immediately.

Problems with the Installment Agreement

Some duties come with the Installment Agreement. When due, the minimum payment should be made. The income of the incomes of taxpayers that were combined or an individual citizen must be disclosed when putting in an application for an Installment Agreement. In some cases, a financial statement should be supplied. All future returns have to be submitted when due and all the taxes owed with these returns should be paid when due. This method of making monthly payments enable the taxpayer to request that the lien notice be removed. In the event the taxpayer defaults on the Installment Agreement, but, the lien can be reinstated.

The taxpayer and the IRS can negotiate an Installment Agreement. However, particular information must be provided and any info could be subject to confirmation. For taxpayers a financial statement will be required.

How to Get Ready to Apply for an Agreement

There are some precautions that should be considered while taxpayers can submit an application for an IRS Installment Agreement. There are some circumstance which can make this a challenging undertaking even though the IRS attempts to make applying for an Installment Agreement a relatively easy process. It is important to get it right the very first time that the application is made since many problems can be eliminated by an Installment Agreement with the IRS.

We’re the BBB A+ rated law firm serving all of Biloxi and Mississippi, that could provide you with expert help. Our many years of experience working on behalf of citizens that have difficulties paying their tax debt with the IRS qualifies us to ensure approval of your application for an Installment Agreement.

Stop letting tax liens command what you can do with the property you possess - give our Mississippi firm that is a call now

What is a lien?

The lien cushions the authority’s claim to all your existing property, inclusive of financial, personal and real estate assets. Typically, a federal tax lien is imposed the IRS analyses your culpability, when they deliver to you a bill that lays out into detail how much you’re owed and additionally when you decline to pay your debts on program. When a lien is submitted, it is transformed by it into a public record matter. Liens typically record the exact figure owed to IRS in the precise time that it’s levied in a public document called the Notice of Federal Tax Lien. The document notifies lenders that the government has a right to seize your property at just about any particular time. Different credit reporting agencies conventionally acquire this particular information so tax liens finally reflect on your credit reports. Tax Liens are commonly active ten days after issuing a demand to clear the stipulated tax debts.

Federal tax liens can certainly be averted from being lodged by paying up all your tax dues before the IRS decide to levy a lien in your assets, and also. They can also be evaded through creating installment deals which sufficiently match the requirements of the IRS as not to file a lien. A federal tax lien is unable to be filed if a taxpayer decided to prepare a streamlined or guaranteed installment treaty. Such arrangements require the citizen keep a balance of less than or an amount $10,000 that for the bonded payment and for that is accord the streamlined agreement it that is, should be $25,000 or less. In a predicament where the citizen owes more than $25, 000, a tax lien can be averted if he or she tries their best to reduce that particular outstanding balance to exactly $25,000 or less and instead lays out a streamlined treaty. There are two methods of removing tax liens: release and withdrawal.

How can I have my lien wiped away?

Withdrawing federal tax liens is like it never existed, when the IRS resort to revoking the lien. The lien is filled erroneously lien withdrawals usually take place. In a case where the tax lien is erroneously filed, contact the IRS when possible. In order to substantiate that you have no tax arrears then take the necessary steps in removing the lien, the IRS agents will assess your account.

Releasing a federal or Mississippi state tax lien typically means that your assets are no longer constrained by the imposed lien. Instantly after lien releasing, the county records will immediately be brought up to date to show that’s has been released. Nevertheless,the presence of a federal tax lien will be displayed in your credit reports for ten years.

What to Do Next

A bank levy may be removed within 24-48 hours, but only in case you act fast and let our Biloxi team help you

Bank levies are charges levied in your Biloxi bank account when you’ve outstanding tax debt. The law allows the IRS to seize funds in your bank account for clearing your tax obligations. Regrettably, the procedure is not consistently smooth. Typically, the institution ends up freezing all the cash that’s available in a specified account for a period of 21 days to handle a person’s or a business’ tax obligation. During the freeze, you cannot get your money. The sole chance of getting them at this stage is when the period lapses, when they’re unfrozen. Preventing the levy lets you access your capital for meeting other expenses.

Why and When Levies Get Slapped On

The IRS bank levies are applied to your account as a final resort for you to pay taxes. It occurs to people in Mississippi who receive demands and many appraisals of the taxes they owe the revenue bureau. Failure leaves the IRS with no choice other than to proceed for your bank account. This happens through communication between the IRS as well as your bank. You will find that on a specific day, if you are not aware. The amount equal exclusively affects to your tax debt, but nevertheless, it can be more than that and you get a refund following the levy period. For meaning to levy plus a telling about your legal right to a hearing, a final notice is followed by bank levies. In short, the Internal Revenue Service notifies you of the pending bank levies. The IRS can only take money which was on the date a levy is applied in your bank when used.

How to Get Your Levy Removed in Biloxi

There is a window of opportunity for you to utilize to get rid of bank levies from your account. By being a step ahead of the IRS you get rid of the bank levies. With a professional service helping out, it will not be difficult for you to be aware of when to take your cash out of the bank. You additionally need to enter into a payment arrangement with all the IRS to prevent future bank levies, before the bank levy happens besides removing your funds. You certainly can do this by getting into an installment arrangement. You can also appeal and seek qualification for ‘uncollectable status’.

They may be very complex to implement, while the alternative seem simple. You have to act fast, have the resources to do so, comprehend every aspect of the law and deal with related bureaucracies imposed by banks and the IRS. The smart move would be to phone us for professional help with your IRS scenario. We’ve got expertise and skills which have made us a number one choice for lots of people. For partnered tax professional aid, contact us for additional information and help.

Are you going to qualify to save up to 90% on your back tax debt? With an OIC deal, this may be the instance

What is an Offer in Compromise Program

The Internal Revenue Service helps the customer faced with serious tax issues bailing them out up to less compared to the sum owed or rather by paying. Yet, not all distressed citizens qualify for IRS Offer in Compromise Agreement. This is just after evaluation of the customer was carried out, because qualification is based on several factors. The IRS Offer in Compromise Agreement plays an instrumental role in helping citizens with distressed financial challenges solve their tax problems. This implies that the IRS functions as the intermediary that helps the taxpayer pay their tax debt in the way that is handiest and flexible.

What Does it Take to Qualify for an Offer in Compromise agreement?

Filling the applications doesn’t guarantee the Biloxi taxpayer a qualification that is direct. Instead, the IRS begins evaluation process and the total appraisal that may leave you incapable of paying your taxes. These programs are then supported with other relevant records that’ll be utilized by the Internal Revenue Service to determine the eligibility of the citizen for an Offer in Compromise Agreement. Nonetheless, there are some of the few qualifications procedure that has to be met completely be the citizen. Some of those qualifications include but not limited to ensuring that the taxpayer files all the tax returns they are legally bound to file, make and present each of the estimated amount of tax payments for the current year and finally the citizen is designed to make deposits for all of the national tax for the current quarter especially for citizens who run companies with workers. These are the three fundamental tenets of qualification that each taxpayer seeking help from IRS must meet in order to be considered.

What to do Next

This is an amazing law firm that’ll function as a yard stick for individuals who need suitable help in negotiating for an IRS offer in compromise arrangement. Do not hesitate to contact them because they’ve a good security standing and a strong portfolio. They have a team of competent and dynamic professionals who are constantly on hand to help you. Try them now and expertise help like never before. It is simply the best when it comes to negotiation of an IRS offer in compromise agreement.

Other Cities Around Biloxi We Serve

| Address | Biloxi Instant Tax Attorney759 Howard Ave, Biloxi, MS 39530 |

|---|---|

| Phone | (601) 840-0005 |

| Customer Rating | |

| Services / Problems Solved | Removing Wage GarnishmentsGetting Rid of Tax LiensRemoving Bank LeviesFiling Back Tax ReturnsStopping IRS LettersStopping Revenue OfficersSolving IRS Back Tax ProblemsIroning out Payroll Tax IssuesRelief from Past Tax IssuesNegotiating Offer in Compromise AgreementsNegotiating Innocent Spouse Relief ArrangementsPenalty Abatement NegotiationsAssessing Currently Not Collectible ClaimsReal Estate PlanningLegal Advice |

| Tax Lawyers on Staff | Steve Sherer, JD Kelly Gibson, JD Joseph Gibson, JD Lance Brown, JD |

| Cities Around Biloxi We Serve | Bay Saint Louis, Biloxi, Brooklyn, Carriere, Diamondhead, Diberville, Escatawpa, Gautier, Gulfport, Hurley, Kiln, Lakeshore, Long Beach, Lucedale, Mc Henry, Mc Lain, Mc Neill, Moss Point, Nicholson, Ocean Springs, Pascagoula, Pass Christian, Pearlington, Perkinston, Picayune, Poplarville, Saucier, Stennis Space Center, Waveland, Wiggins |

| City Website | Biloxi Website |

| Wikipedia | Biloxi Wikipedia Page |